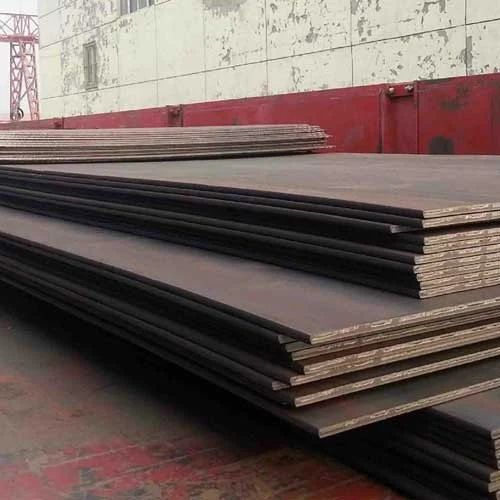

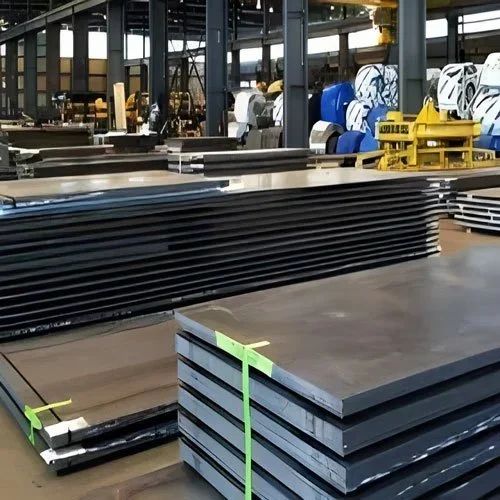

Corten Steel Supplier & Manufacturer

Corten Steel Supplier & Manufacturers S355J2G3 VS S355J2+N STEEL PLATE S355J2W+N STEEL PLATE IRSM 41-97 CORTEN STEEL PLATE & SHEET SUPPLIER CORTEN A STEEL PLATE What is corten steel Plate Corten steel, also known as weathering steel, has gained popularity in recent years for its unique aesthetic appeal and practical benefits. It is a type […]