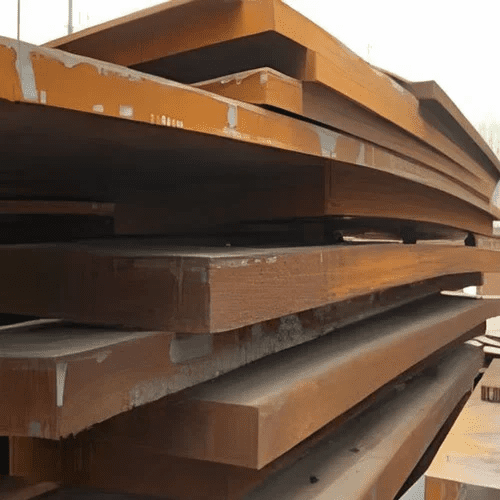

Corten Steel Pipe

CORTEN STEEL PIPE Corten Steel Panels Corten Steel Planter Structural Steel Beam High Tensile Steel Plate >> What is Corten Steel Pipe? >> Equivalent grades of Coren Steel Pipe >> Mechanical Properties of Corten Steel Pipe >> Chemical Properties of Corten Steel Pipe >> Corten Steel Pipe Specification! >> Corten Steel Pipe Price >> Our […]